Understanding the Stock Market PE Ratio: A Key to Smart Investing

When evaluating stocks in the stock market, the Price-to-Earnings (PE) ratio is one of the most crucial metrics investors use. It provides a quick snapshot of how much investors are willing to pay for each dollar of earnings a company generates, making it a vital tool for analyzing stocks. In this post, we’ll break down what the PE ratio is, why it matters, and how you can use it to make informed investment decisions.

What is the PE Ratio?

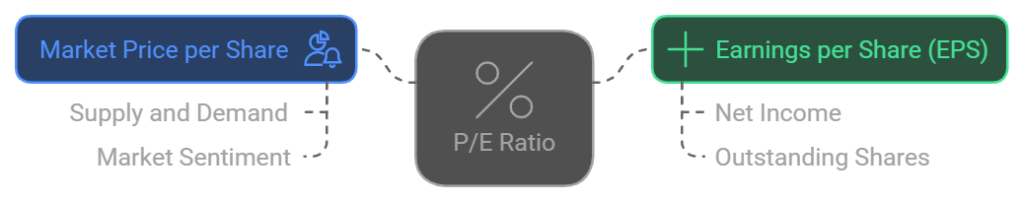

The PE ratio stands for Price-to-Earnings ratio, which is a simple formula used to measure a company’s valuation:

The PE ratio tells you how much investors are willing to pay today for a company’s earnings. For example, if a stock has a PE ratio of 20, it means investors are willing to pay ₹20 for every ₹1 of earnings the company generates.

Types of PE Ratios

- Trailing PE Ratio: This is based on the company’s earnings over the past 12 months (known as trailing twelve months or TTM). It provides a historical perspective on a stock’s value.

- Forward PE Ratio: This uses estimated future earnings, giving a forward-looking view of a company’s potential performance. It is often used by investors to project future growth and value.

Why is the PE Ratio Important?

The PE ratio is often referred to as a valuation metric because it helps investors determine if a stock is overvalued, undervalued, or fairly valued. Here are some reasons why it’s important:

- Relative Comparison: The PE ratio allows you to compare the valuation of companies within the same industry or sector. For example, if Company A has a PE of 15 and Company B has a PE of 30, Company A is considered cheaper relative to its earnings.

- Market Sentiment Indicator: A high PE ratio may indicate that investors expect strong growth in the future, while a low PE ratio could suggest that the market has low expectations for future performance.

- Risk Evaluation: The PE ratio can help you assess the risk of a stock. A stock with a very high PE might be riskier because it implies that investors expect significant future growth, which may not materialize.

How to Use the PE Ratio in Stock Analysis

- Compare with Industry Averages: The PE ratio should not be viewed in isolation. Comparing a company’s PE ratio with the industry average can help you gauge its relative valuation. A stock with a PE ratio higher than its peers may indicate that it’s overvalued.

- Growth vs. Value Stocks: Growth stocks typically have higher PE ratios because investors expect rapid earnings growth in the future. Value stocks, on the other hand, have lower PE ratios and are considered “undervalued” relative to their earnings potential.

- Historical PE Trends: Looking at a company’s PE ratio over time can give you insights into how the market views its earnings potential. If the PE ratio is steadily rising, it might suggest growing confidence in the company’s future.

Limitations of the PE Ratio

While the PE ratio is a valuable tool, it does have limitations:

- Earnings Manipulation: The ratio relies on earnings data, which can be influenced by accounting practices. Companies may use tactics to inflate earnings temporarily, leading to misleading PE ratios.

- Not Suitable for Negative Earnings: The PE ratio is meaningless for companies with negative earnings, making it less useful for analyzing startups or companies in financial distress.

- Sector Differences: PE ratios vary across industries. For example, tech companies often have higher PE ratios than utilities because of their growth potential. Therefore, it’s essential to compare PE ratios within the same sector.

Conclusion

The PE ratio is a powerful and widely-used tool in stock market analysis. It helps investors understand how much they are paying for each dollar of earnings and whether a stock is overvalued or undervalued. However, like any financial metric, it should be used in conjunction with other indicators and insights for a well-rounded analysis.

Understanding and interpreting the PE ratio correctly can lead to smarter, more informed investment decisions. Whether you’re a beginner or a seasoned investor, incorporating the PE ratio into your analysis will help you better evaluate stocks and navigate the stock market with confidence.

For more insights into stock market investing, IPO updates, and financial guides, visit nextipoindia.com. Keep up with the latest trends and make informed investment choices!